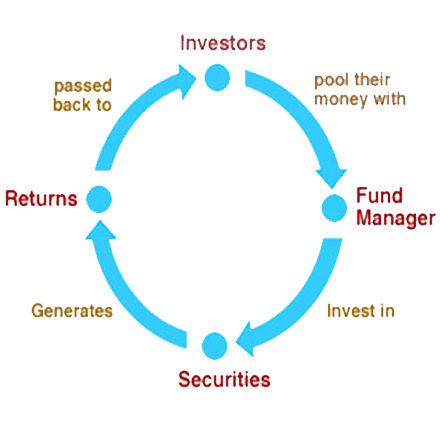

Most of them confused and complicate the mutual funds methodology. We are going to simplify and teach you about the basics of investing in mutual funds and what are the rewards we can gain out of these funds. A small / mid investor’s & from many investor’s funds will be pooled funds and managed by the financial institutions. Investor, can access to professionally managed portfolios like, equities, bonds, financial instruments and other securities. The entire portfolio is been maintained by the large fund houses or financial institutions.

So the investor participates proportionally in the gains or losses of the fund. The income/gains generated from this collective investment is distributed proportionately amongst the investors.

We are going to educate more on hidden side of mutual funds and how to easily identify and analyze the funds. The large funds houses loaded with professionally driven team and they pull the entire history of the company. We will educate you the entire information about the Basics of investing in mutual funds.

The main advantages of the mutual funds are they have an expert fund manager who studies each company health & history. Since It’s their key job role, they devote their time and pick the company for investments. As a investor, we need to study the financial statements like P&L, Balance sheet, Ledgers, Revenues, Cost, Expenses, Business expenses of the company before we invest . We don’t have time and some financial parameters are needed to run through in the detailed manner to realize. Example: Ebit & Margin…